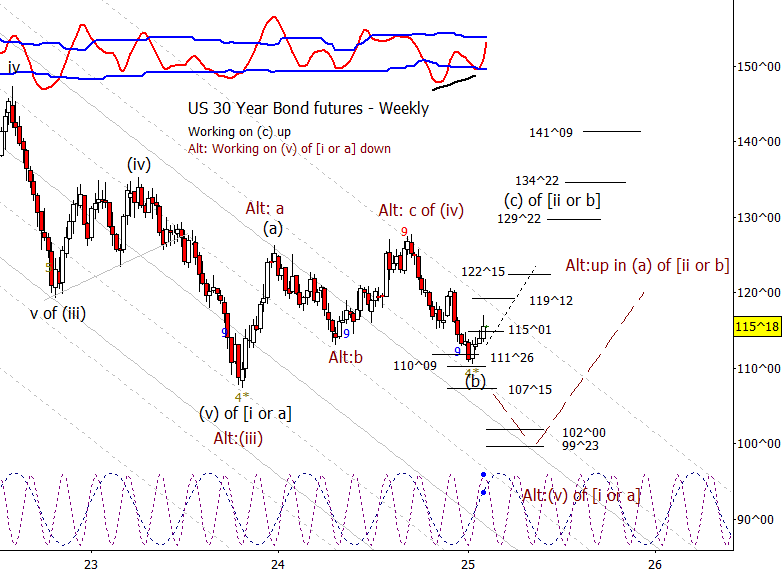

Bonds

ZB continues to behave well as it now works to base above 115^01. I expect bonds to continue to grind higher into at least 122^15.

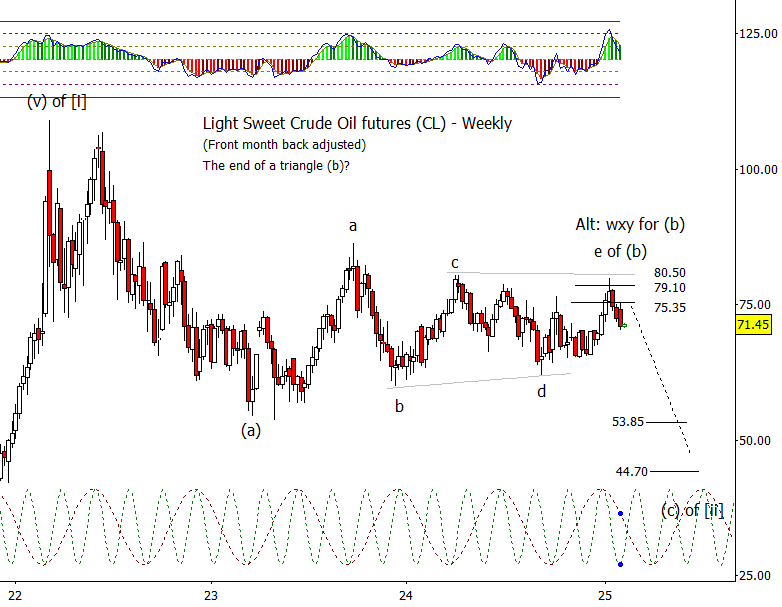

Crude Oil

Crude Oil is also on plan as it fell away from 75.35. I think it likely that CL is early in a (c) wave down that will last months. On lower time frames, I expect a bit of a bounce to form a lower high prior to the next leg down.

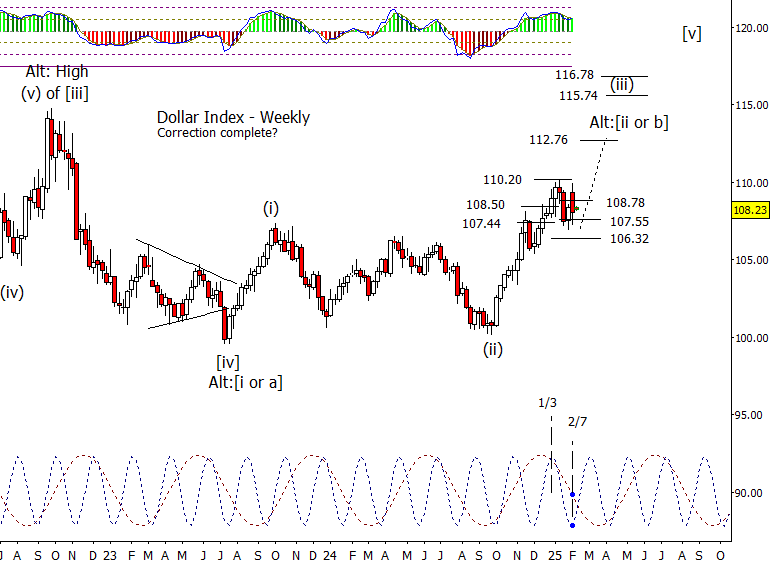

Dollar Index

DX really didn’t do anything last week aside from probing the recent range. This is consistent with the correction or consolidation hypothesis. Is that consolidation complete? Not certain, I think it may be close looking at lower time frames.

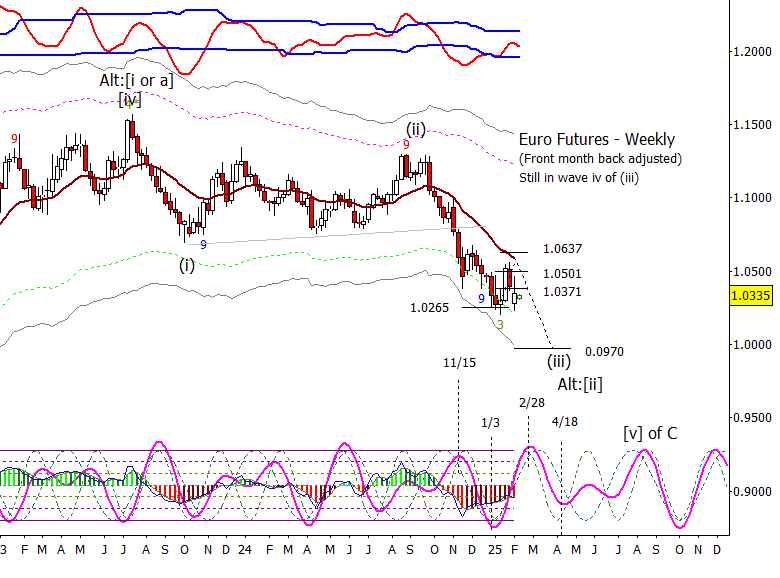

Euro

I may have jumped the gun on calling the Euro consolidation complete as it may attempt to bounce a little after retesting the 1.0265 support last week.

Gold

Now that gold has made it over the autumn high from last year, it could make a try for 3000.00. Next square of nine target is at 2944.90.

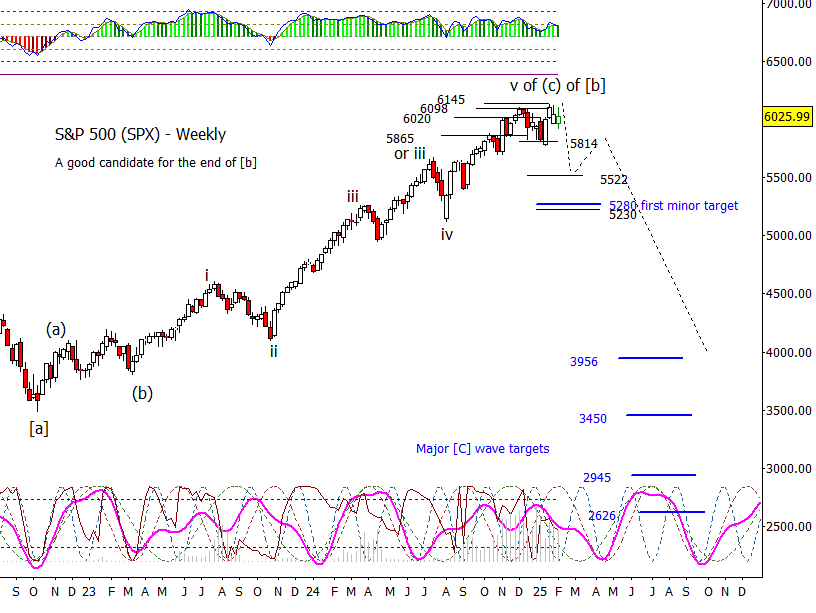

S&P 500

So far SPX has two weeks of lower highs but thus far has failed to break down and put pressure on 5814. Will we see yet another high? I can’t rule it out as the market has been sideways for about two months now. You may think, ah just another correction an thus due to make another high. Maybe, but consider that highs in equity indices tend to not have clear spike highs but to take on a more rounded form. This is just a way of saying that my view really hasn’t changed, dangerous to chase up but also dangerous to fade prior to a break of 5814.

Bitcoin Futures

So far BTC has a possible double top but is still holding above 91110. We will see if a lower high forms on this bounce.