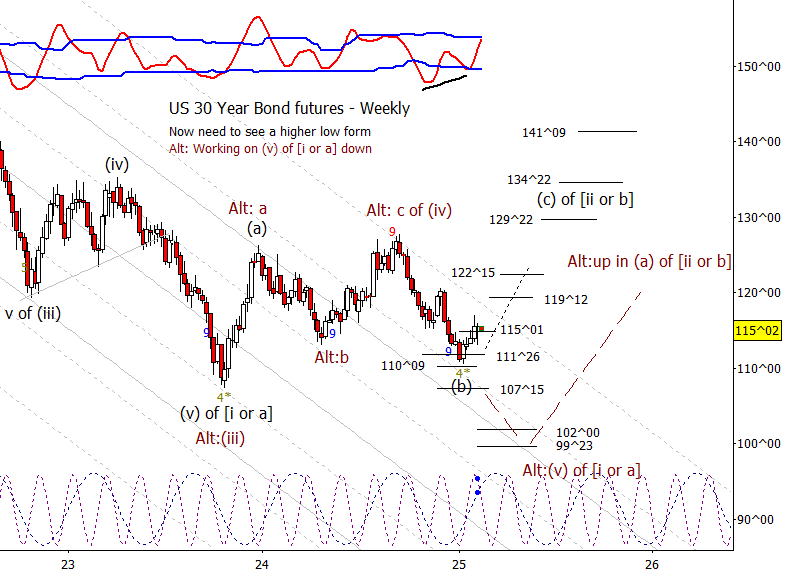

Bonds

The last six weeks of advance in bonds is pausing a bit but not something I’m particularly concerned about, but this correction will be the first real test of whether the (b) wave low is set. I’m looking for a higher low to form over the next couple of weeks.

Crude Oil

While I think there is a good chance that the (b) wave has completed, I think bears have to allow for a few weeks of bounce for a lower high to develop.

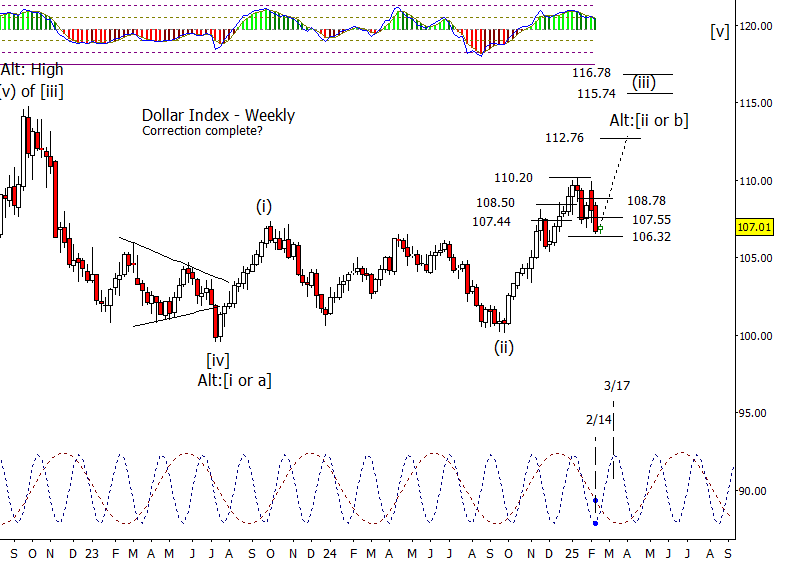

Dollar Index

DX dropped down through the 107.55 support last week to nearly test the next support at 106.32. I’d like to see DX recover 107.55 this week as a first sign that the correction is complete.

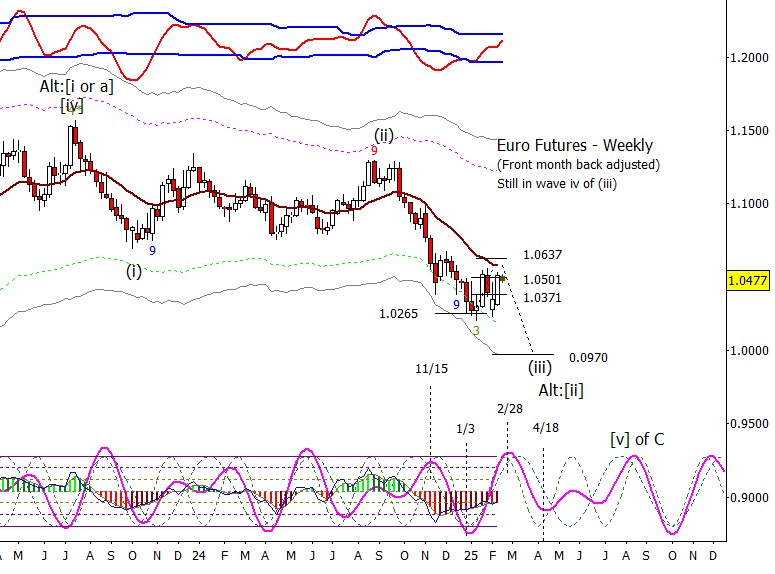

Euro

Looks like we are still waiting out the correction, I’m labelling ‘iv of (iii)’, in Euro to complete. Higher in price is not required though a tap of the 20 EMA wouldn’t be out of the question. For time, the end of the month is the next major cycle inflection in the cycle composite.

Gold

Gold stuttered after reaching 2944 but couldn’t fall back under old resistance turned support at 2890.90. I think the door is still open to make a try at 3000.00 even if I think the advance is long in the tooth. Net, not a fan of chasing up but too early to fade.

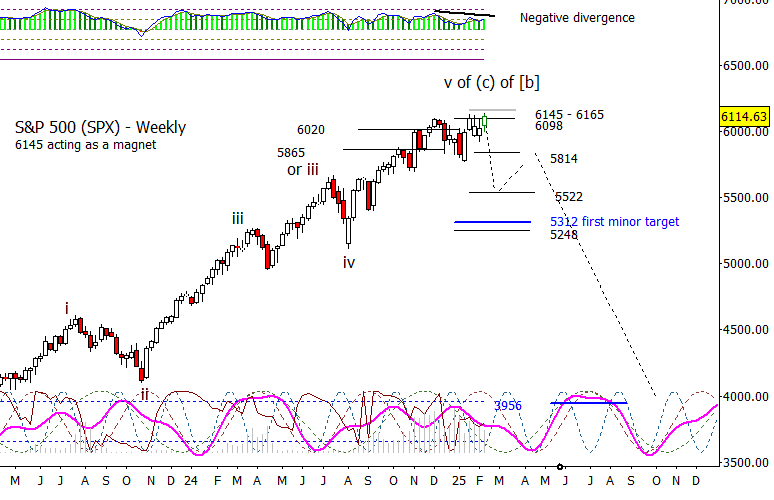

S&P 500

I know I sound like a broken record but just can’t be excited about higher. The market seems to be interested in testing the next overhead targets in the 6145 to 6165 area.

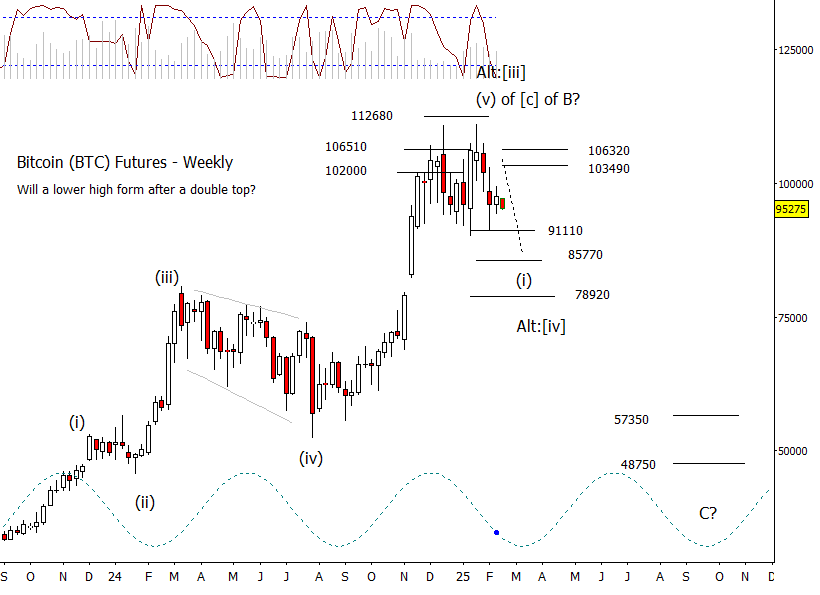

Bitcoin Futures

BTC is not acting that well after the minor new high/double top in January. I think softness in BTC bodes ill for the equity markets.