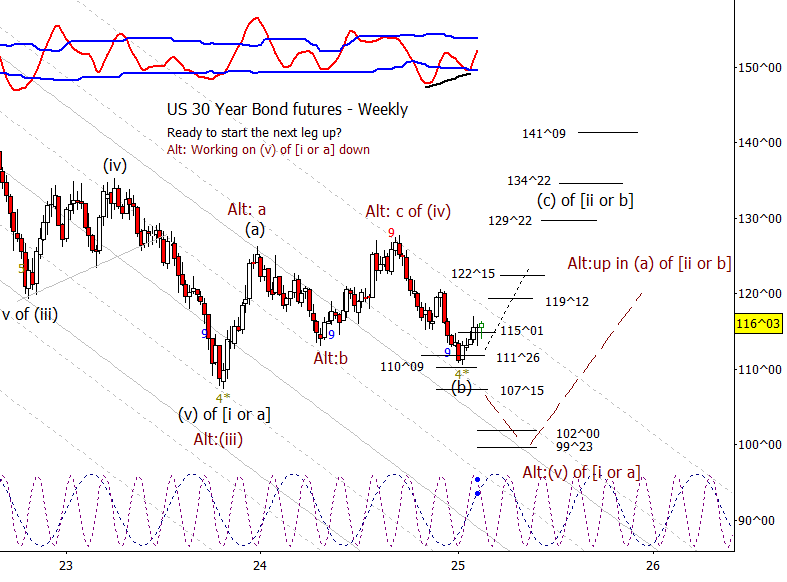

Bonds

A higher low may be set in bonds which would set the stage for the next drive higher toward at least 119^12 and likely higher.

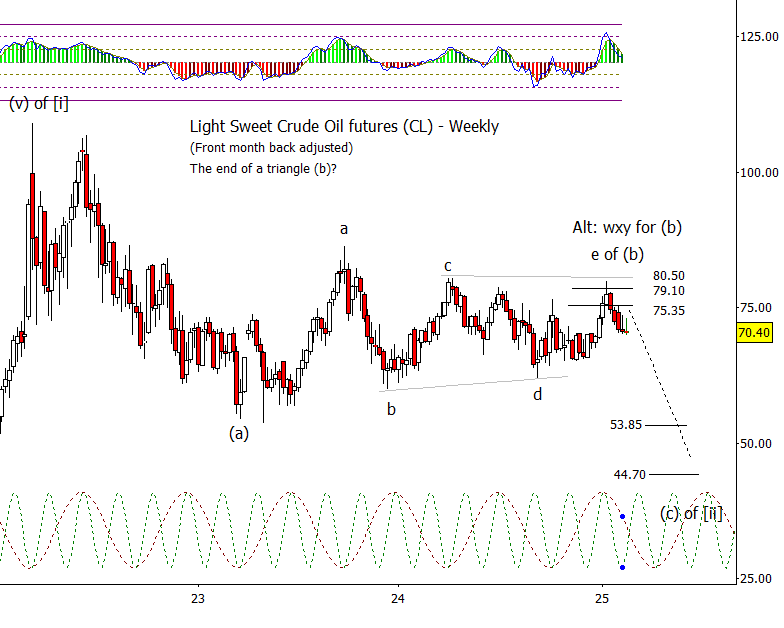

Crude Oil

I had originally thought that the initial impulse down from (b) in crude was complete but I’m now thinking it isn’t quite done. Once that impulse is complete, we should allow for a bounce in a wave two to form a lower high.

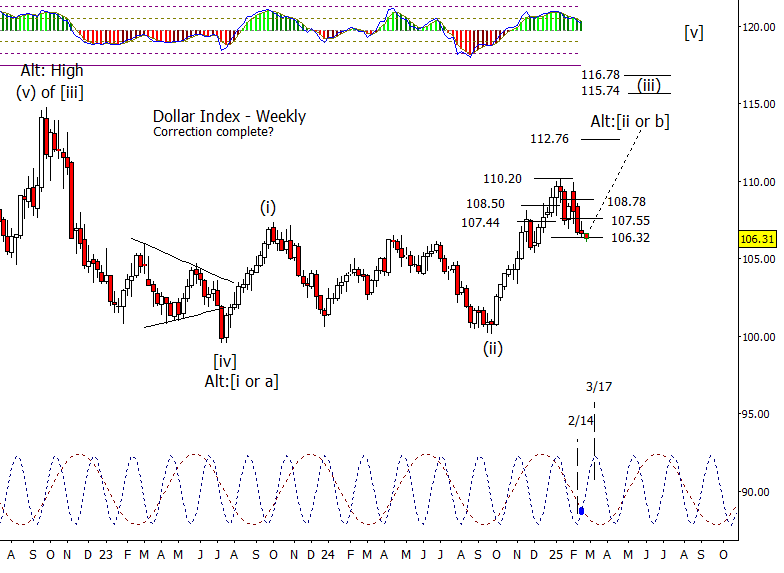

Dollar Index

DX has been under pressure for the last four weeks, but I think it can start to firm up against 106.32.

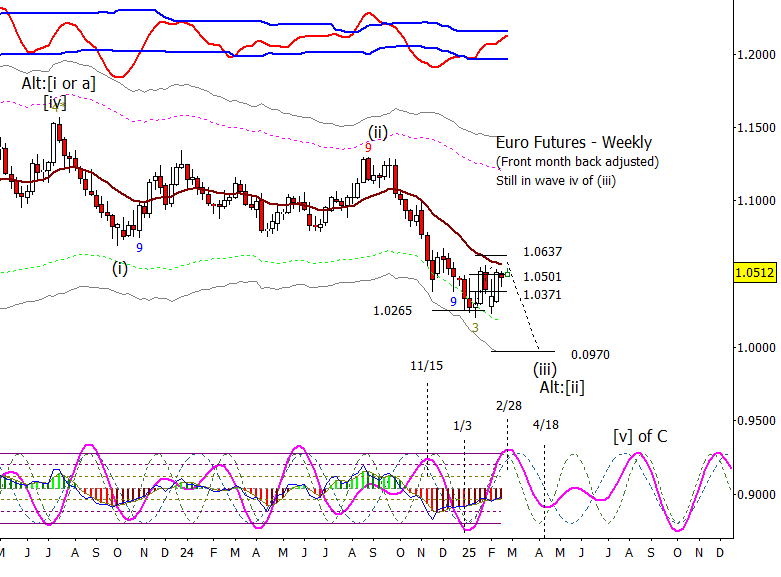

Euro

Euro is retesting the top of the range it has been in for the last couple of months. I still like this as a wave ‘iv of (iii)’ that is near completion. Note how the RSI at the top of the chart is near overbought while the composite cycle has an inflection point due.

Gold

Gold is still trying to stretch to test 3000.00. From the look of the cycle composite, I’d say gold bugs have the next two weeks to make it happen.

S&P 500

Last week ended on a weak note as the S&P 500 was down on Thursday and Friday. Is the market finally beginning to break? Maybe. I think it is best to assume yes at this point and see what the bears can do. The first major support bears need to take out is at 5854.

Bitcoin Futures

I wonder if BTC is working on the first impulse down from the double top. If so, we should see BTC futures push for a new low under 91110 prior to the next bounce.