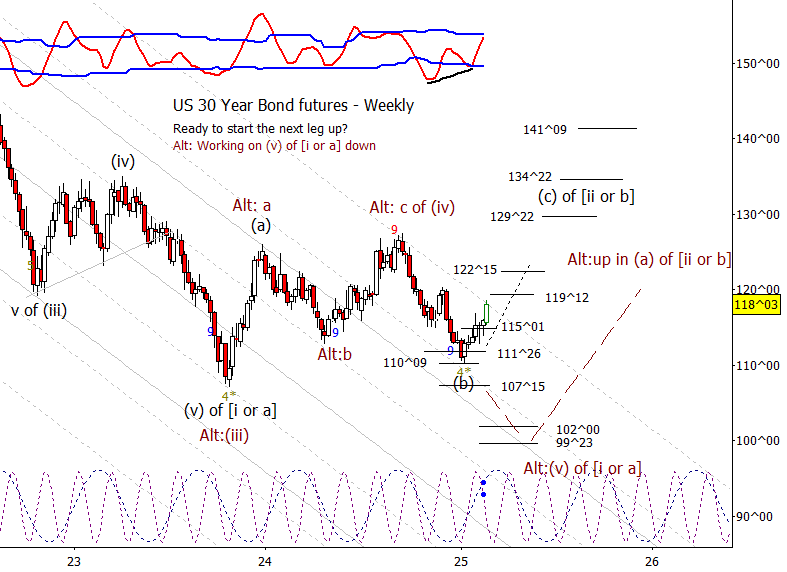

Bonds

ZB put in a solid advance last week. I wouldn’t be shocked if it slowed down against 119^12 and a prior swing high at 120^11 though think it should find a way to grind on toward at least 122^15.

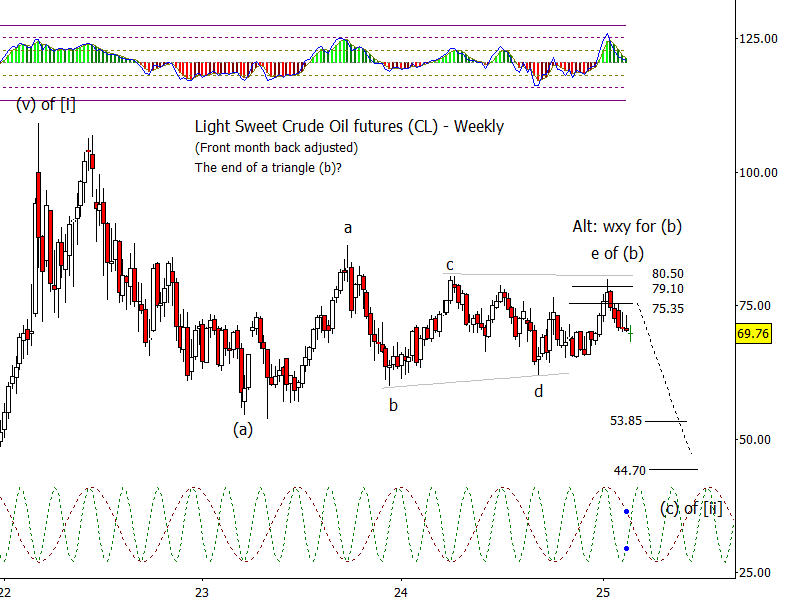

Crude Oil

Crude leaked a little lower last week but ended with a doji candle. I favor a week or two of bounce which would correspond to the fast cycle turning up into the middle of the month.

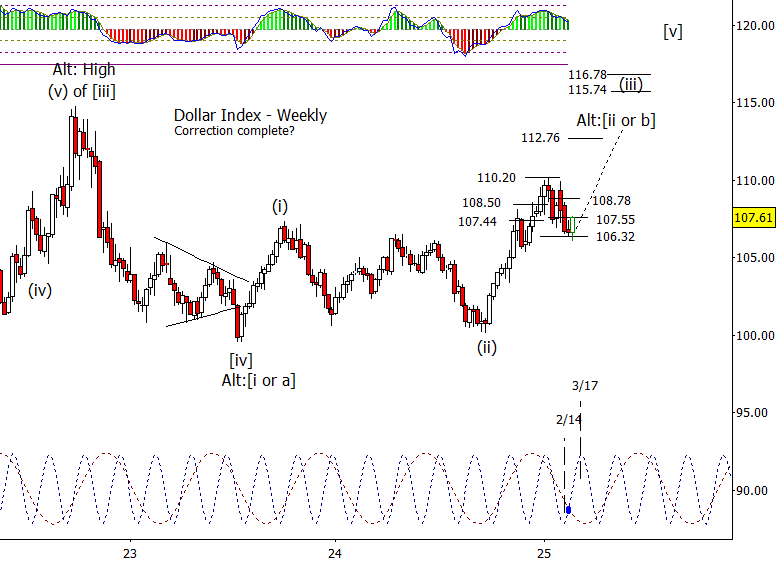

Dollar Index

DX finally showing signs of life after about two months of correction. Next step for bulls is to base above 107.55.

Euro

Euro acting like it is finally getting the wave ‘v of (iii)’ down started. Next step is to spend time under 1.0371.

Gold

Last week was one of the largest drops in gold for the last year. While I suspect this is the long-awaited reversal down in the start of a significant correction, I really can’t say that in the big picture till under the 2797.70 to 2769.90 zone.

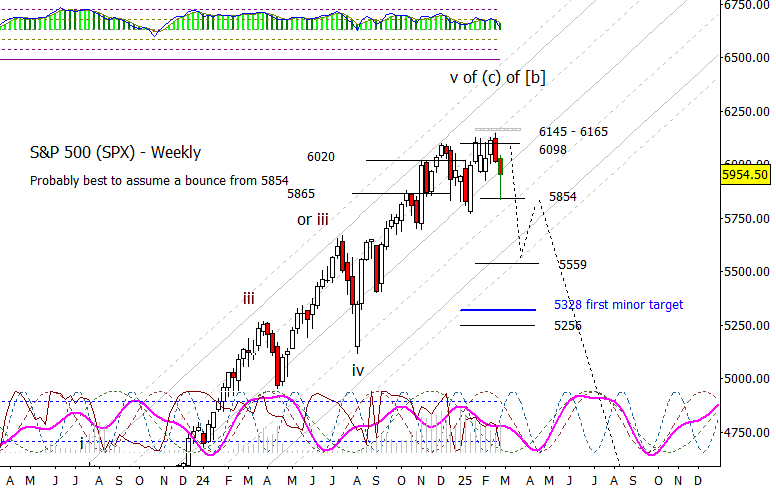

S&P 500

We had a second week of weakness in the S&P 500 last week. Certainly a promising drop but note that SPX tested the first support at 5854 on Friday and bounced up a hundred points. If bulls hope to make a new high, this is their chance. I’ll be watching for a lower high to form in a week or two. I’m interested in seeing if bears can press again mid-March.

Bitcoin Futures

Bitcoin futures tested support at 78920 and have bounced fairly hard. Like the S&P 500 above, I’m interested in seeing if a lower high forms over the next couple of weeks. Overhead resistance is at 98550 and 103410.