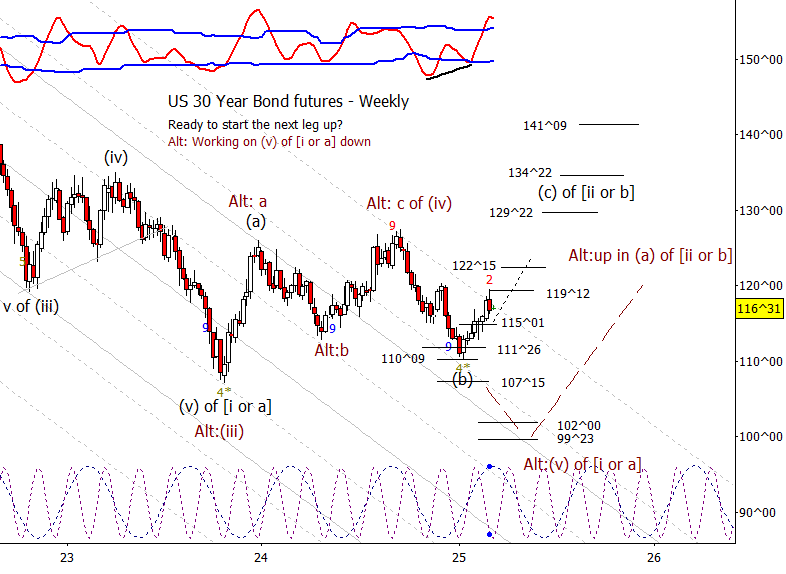

Bonds

Bonds were up last week but ran into a bit of resistance against 119^12. I favor higher to at least 122^15 but I can’t rule out a retest of old resistance turned support at 115^01 first.

Crude Oil

The good news is that CL has pushed down from the January high as expected. The bad news is that I haven’t really been dialed into the lower degree movement as I have been expecting a minor bounce and CL instead moved lower. While I certainly expect crude to move much lower, eventually push well beyond the 2023 low, I’m struggling a bit with the lower degree count.

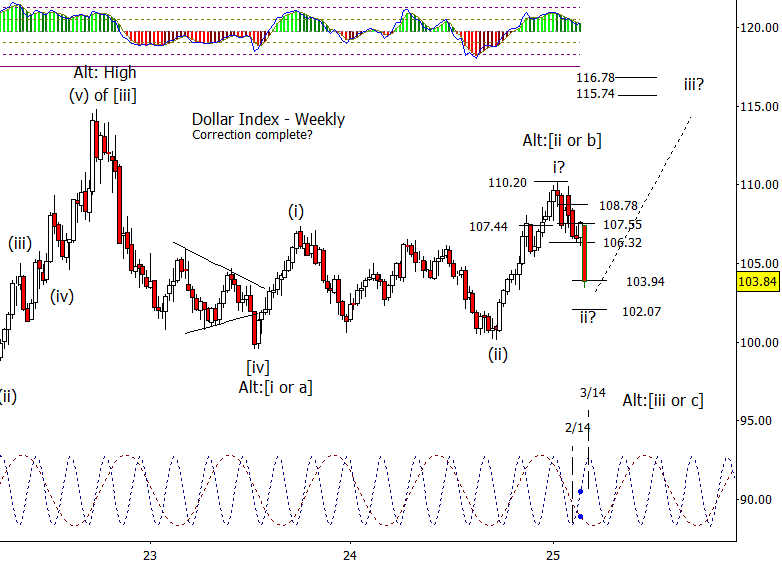

Dollar Index

DX had a bad week last week breaking down from the 106.32 support. Bears are now doubt convinced that the high near the start of this year was a major high and now expecting DX to take out the low from 2023 later this year. I acknowledge that as a possibility but I going to dig in my heels a bit and say that perhaps we have only seen the first leg up from the 2024 low and have more to go, namely this correction is a wave two. We will if DX begins to attempt to firm up against 103.94 or just a little lower over the next couple of weeks.

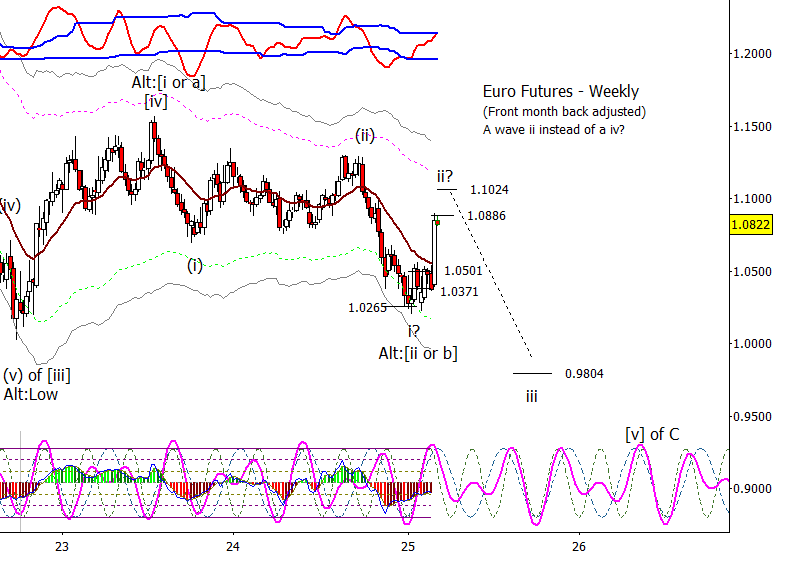

Euro

Same idea but in reverse of DX above. Yes, there was a strong move up last week, but I am highly skeptical that this is the start of something, instead near an end. Another idea that I have had while working on this is that perhaps there is a type of ending diagonal at work down from the 2023 high which would make this two but likely of higher degree.

Gold

I know on lower timeframes I have given up on a lower high and am assuming gold attempts a final high near 3000.00 however at this scale that isn’t a sure thing. Net, I wouldn’t try to chase up but attempting to fade is very aggressive while above 2797.70.

S&P 500

The case for the high being set in the equity indices is improving with the drop last week under the prior low back in January. Where are we in that decline? Not clear but I’m assuming there is more to go, perhaps net lower into the next major cycle inflection in April. The first major wave is difficult to forecast as we don’t have much reference, but I would guess between -10% to 15%.

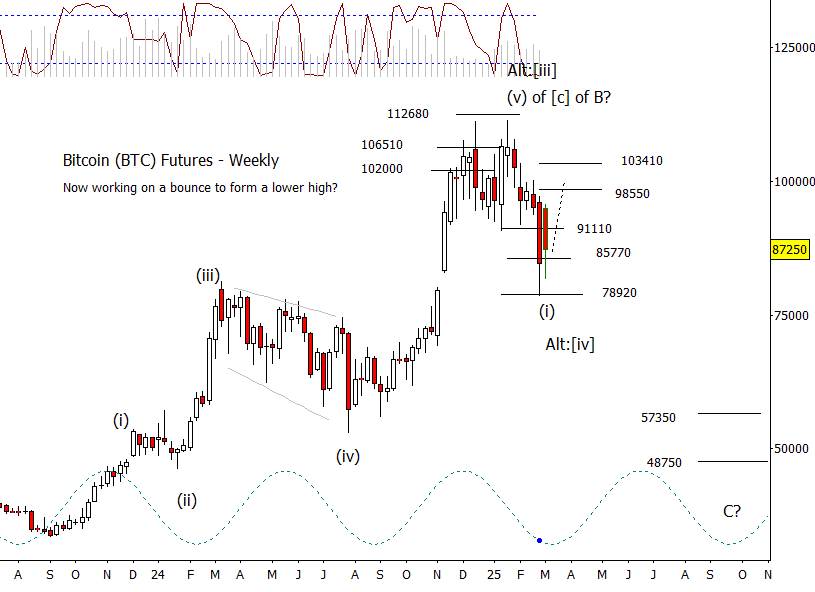

Bitcoin Futures

BTC certainly is acting poorly but I’m not sure we need a new low under 78920 prior to a bounce.