Bonds

Bonds slipped a little last week, but I still lean to a higher low holding and for advance into later in the year. The RSI, top of the chart, is still resetting as it has yet to test the lower volatility band. Next cycle inflection is next week so perhaps the FOMC statement is taken as dovish.

Crude Oil

I was a little surprised by the weakness in CL last week, but it doesn’t materially change my forecast. The question now is do we get a higher low or a new low in [B]? I don’t know. Cycles seem to favor a bounce from here, but we could always end up with a cycle inversion where the next inflection, due in two or three weeks, turns into a low.

Dollar Index

DX has had a decent start at climbing out of the hole. A case can be made that on a lower time frame for retest of the low or a new low. Will see how it behaves after the FOMC on Wednesday.

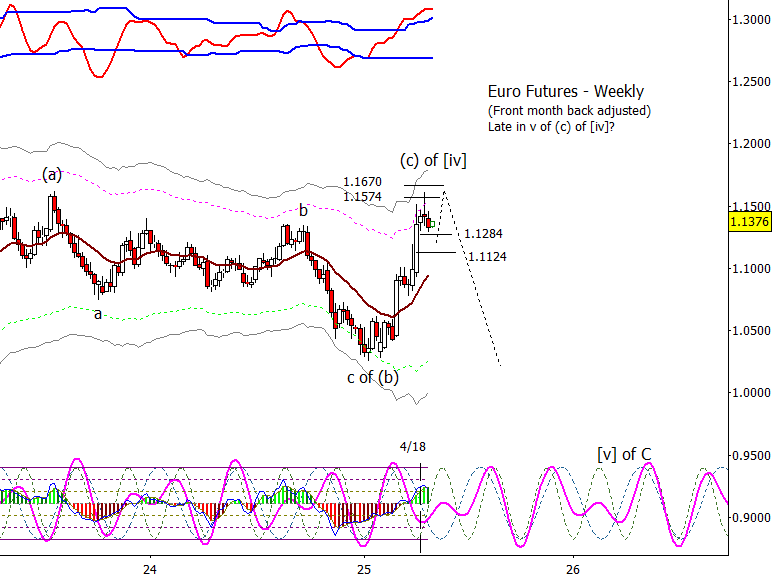

Euro

Same idea as the DX above but the inverse. Possible that a retest or a minor new high on the swing is required to complete the count up from the start of the year.

Gold

Gold has retraced for about three weeks and is down to the minimum required for a wave if. Will gold sprint to a new high from here? I don’t know. Possible that if follows the same path as the Euro and retest or make a new high relatively soon but it may also chop sideways for an extended period and drag out making a new high till late summer.

S&P 500

SPX is playing out so far much as I expect, challenging the area where it is started the acceleration lower. I’d like to see it reverse in this area and head lower to retrace the recent gains before moving higher into June or July to form a lower high, essentially a right shoulder in a head and shoulders formation. Could they move on to a new high this summer? Possible though not my base case. Here is the monthly chart that summarizes the two scenarios that I think most likely. I favor the one that follows the major cycle lower into next year. The alternate is where the cycle inverts and instead becomes a high.

And on the weekly chart, you can see where the market is now back to the ‘scene of the crime’. Yes, it might push a bit more get back to where it was in early March but don’t think it is required.

Dropping down into the 240-minute chart of the futures, you might make the case for one more swing high being needed but I’m reluctant to count on it as I think the major work has been done.

Bitcoin Futures

I think BTC is doing something similar to SPX above, late in the first wave of what will turn into a three-wave bounce.