Bonds

I still think there is a good chance that bonds set a medium-term low May and are basing ahead of a move up in the second half of the year. The goal for bulls is to not lose much ground into the next cycle inflection around the middle of July.

Crude Oil

I know it is difficult to accept my primary view in crude with current geopolitical events, but I think we are pretty late in the formation of a (b) wave high in CL. Perhaps a few weeks of sideways followed by a minor new high, but I think the next major move in crude will not be a push to $100+, but instead a push back toward $50 if not just under to around 46.20.

Dollar Index

On lower time frames, I have been open to a minor new low in DX prior to a meaningful reversal but I’m not sure we get one now.

Euro

I wouldn’t mind a minor new high in Euro over 1.1712 but things can start to go wrong for Euro bulls. Would be bears need Euro under 1.1268 to really get traction.

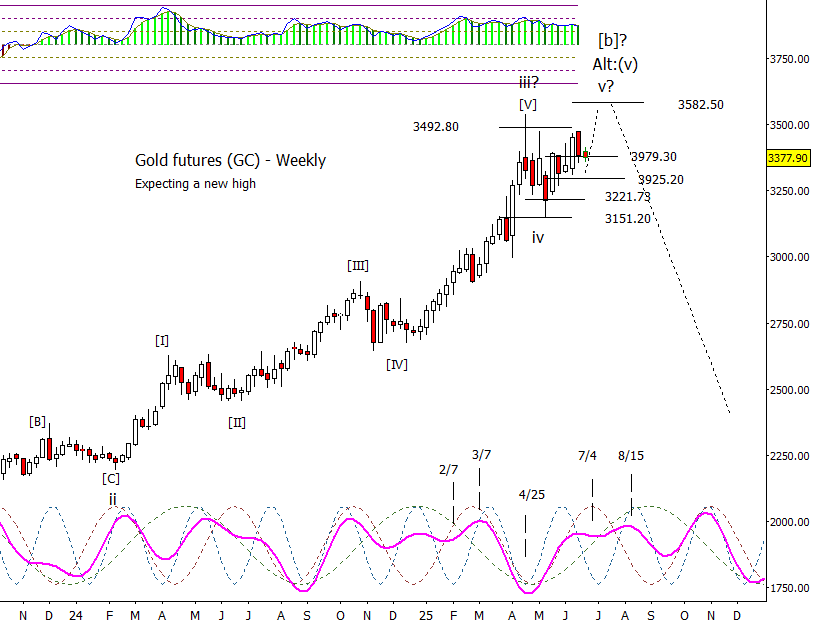

Gold

Much like in DX and Euro, is suspect we are nearing an important inflection point. My basic assumption is we haven’t yet had the reversal yet, but late in the game.

S&P 500

My primary view has been that there needs to be a correction prior to the next major reversal which I think will be lower high to that in February. The longer the correction is put off, the more I worry the market is sleepwalking into something that turns into more than a correction, but instead a slow rollover that accelerates later in the year.

Looking at the futures for what is taking place at the moment, there was a gap down on the Sunday open and recovery overnight. Over 6039.00 invites a push for 6060.75. Looking back at the last couple of weeks, is there anything clearly impulsive? No, which means I can’t rule out another push above 6100 as much as I don’t like it.

Bitcoin Futures

Similar to SPX above, I prefer a bit of a retrace prior to setting the final high or lower high for the summer. The danger is that we already are seeing risk off starting and the high for the year has been set.