Bonds

Bonds continue to act well as the expected reversal up is looking more convincing. I expect bonds to rise into the end of the year.

Crude Oil

The drop in crude is probably too much for me to hold my prior view that there is another attempt to retest 77.60. Instead, any bounce is more likely to be for a lower high prior to pushing down to at least $50 if not a little lower.

Dollar Index

DX broke under 98.26 and now testing minor support at 97.20. I can imagine the next little support at 96.40 being tested at some point in July. That said, I think DX is late in a (c) wave. Bears will see this as a third wave down from the 2022 high that has a minimum target of 95.00 but could extend much lower.

Euro

Same story in general as DX but the inverse as you would expect. I do think Euro is slightly softer than what I would expect from looking at the DX chart. RSI could be developing negative divergence on this high. The composite cycle points to an inflection a few weeks later than the DX cycles but similar.

Gold

Backing up and looking at a weekly chart, gold has the look of a consolidation, so the wave iv is still alive. I know I have started to entertain the possibility of a truncated high on lower time charts, but even that calls for a bounce from near here. Both ideas call for up in the near-term, the difference will be if we get a lower high or a minor new high.

S&P 500

So much for a lower high in the S&P 500 as they sprinted to a new high. Great you say, everything is fine right? No, I don’t think everything is fine, just a delay in what is to come. Over the next few weeks, they may try for the 6242 to 6311 area, but I think this is the end of something, not the beginning. For this week, aside from a minor new high today perhaps around 6262.00 in futures, I expect sideways action.

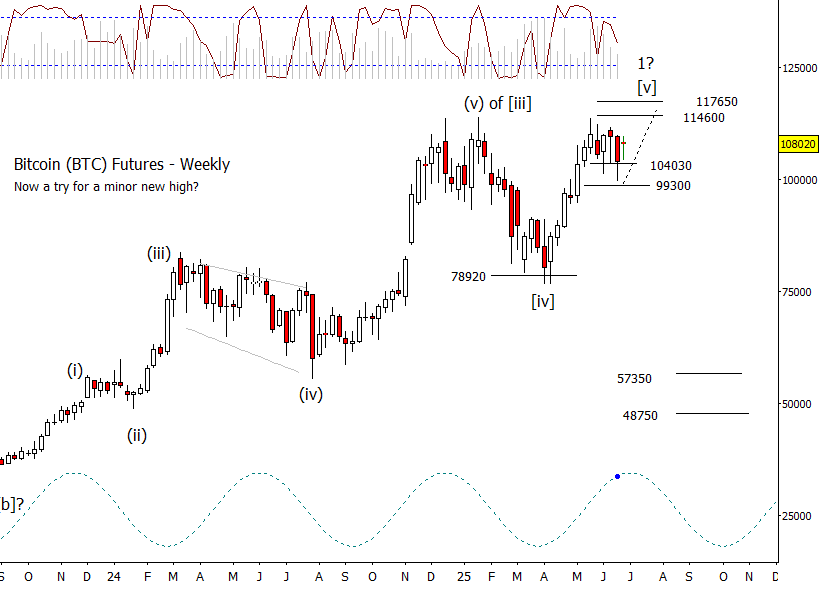

BTC Futures

I have been expecting a consolidation and that may be complete with the four weeks of sideways movement. Now open to a try for a minor new high in July but like the equity indices, think it very late in the game.