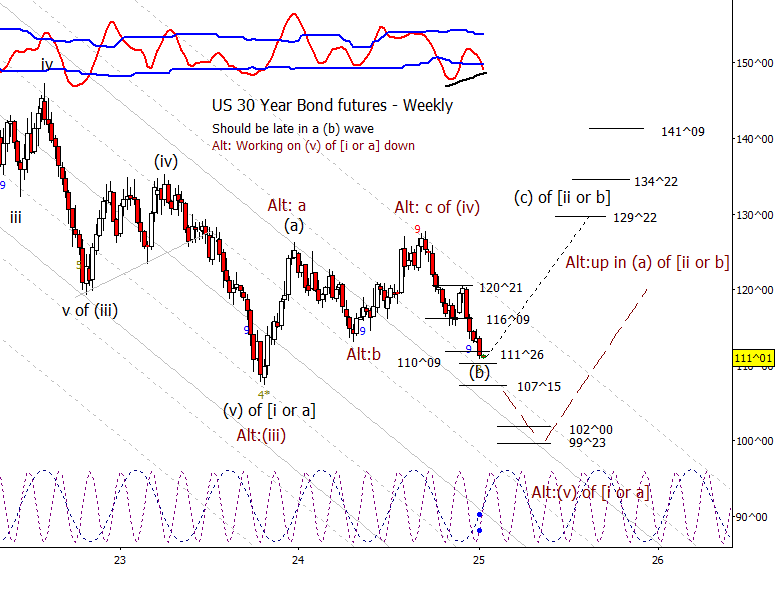

Bonds

ZB has been softer than I like but I don’t see a reason to radically alter my view of seeing this as a (b) wave late in development. I will say that if bonds fail to bounce back out of the 111^26 to 110^09 window, that we should expect a retest of the 2023 low. Note that I don’t have a problem with higher long rates, it is just how they get there. I’m actually pretty bearish bonds in the long run. The alternate path, that this drop is wave ‘(v) of [i or a]’ would mean that bonds will bounce or consolidate for a couple of years before starting the next leg down whereas in my preferred scenario we are already a year into the consolidation.

Crude Oil

While technically the wave ii count is still alive as CL is still under the April high, it doesn’t have much runway left which means the alternate will probably be promoted to primary. Once over 79.00, not too much to get in the way of testing 82.90.

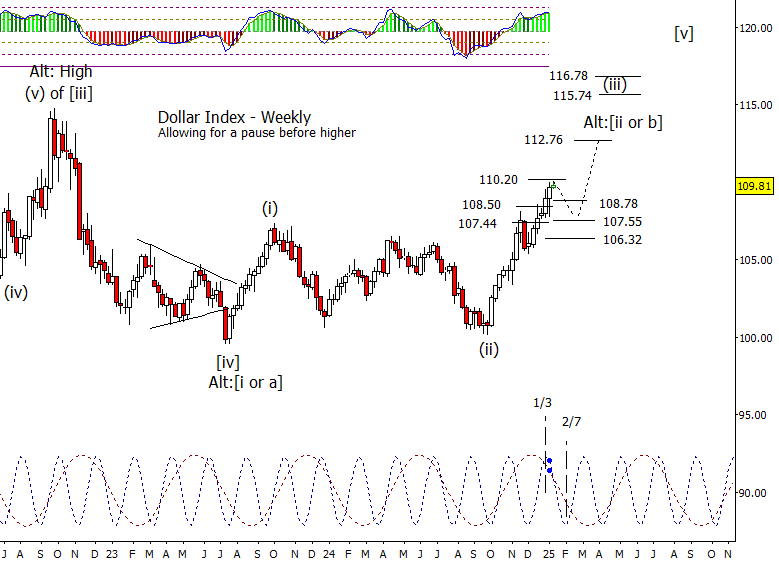

Dollar Index

I’ve been expecting a modest correction in DX and DX has been laughing at me. I still think a small correction would look good but not expecting much from it.

Euro

Interesting that Euro is showing more signs of a stall than DX as Euro has spent three weeks holding 1.0265. Again, just thinking a minor consolidation would look good here prior to resuming the move lower.

Gold

Gold had a strong week, but I don’t think it is the start of something, but instead near the end of what will become a lower high.

S&P 500

A bad looking week in the S&P 500 last week as 6020 was used as overhead resistance. Is the high in? Odds are increasing that it is but still possible for bulls to save SPX, but they probably have to firm up this week, especially after the economic numbers on Tuesday and Wednesday morning.

Bitcoin Futures

I’d like to give BTC bulls a chance for a new high, but I don’t like the pressure being put on 94250 though bears don’t have a definitive win till under 88010.